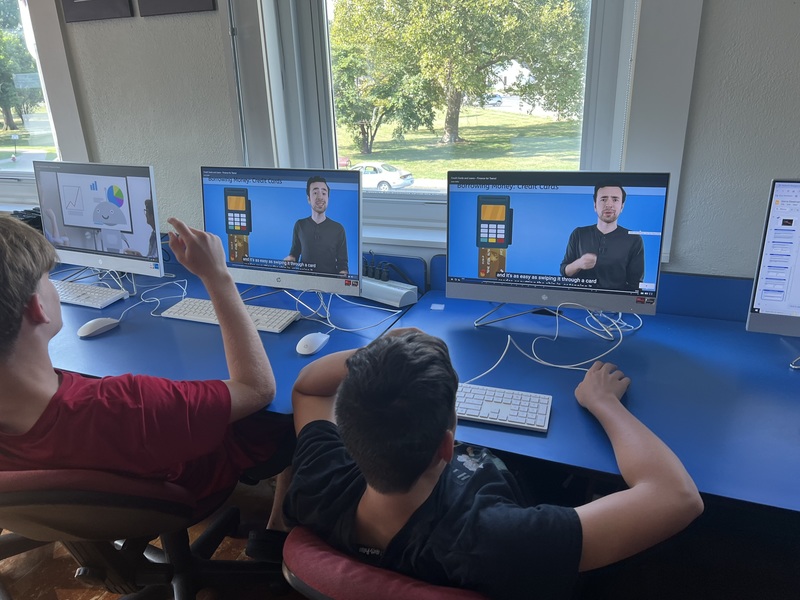

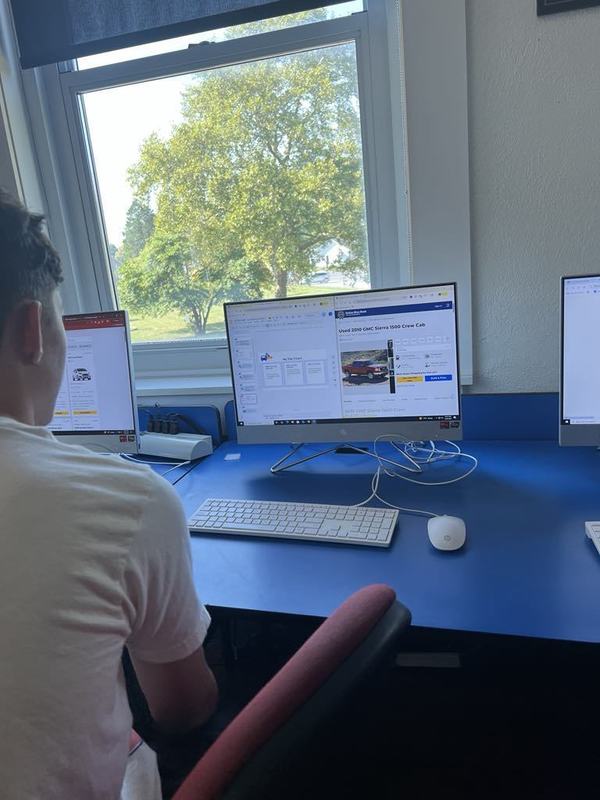

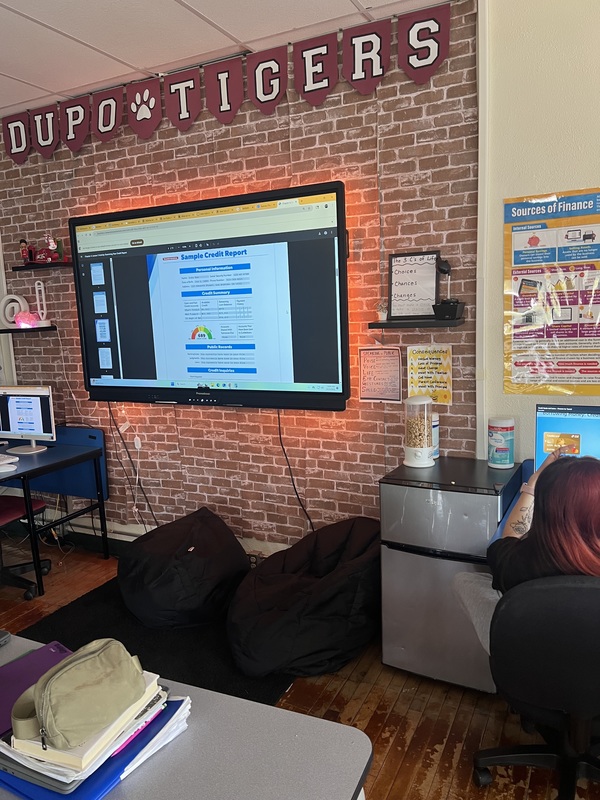

Mr. Griffin and his Consumer Education/Personal Finance class are currently completing an in-depth unit on Credit and Debt. Throughout this unit, students are learning about essential financial concepts, including credit cards, different types of loans, lenders, APR and interest rates. They even looked into strategies to avoid identity theft and the debt cycle trap. The class is exploring real-world financial scenarios to prepare for future decision-making, including reviewing good/bad credit reports, and even CarFax vehicle history reports, understanding how to purchase a vehicle new or used, and evaluating various financing options.

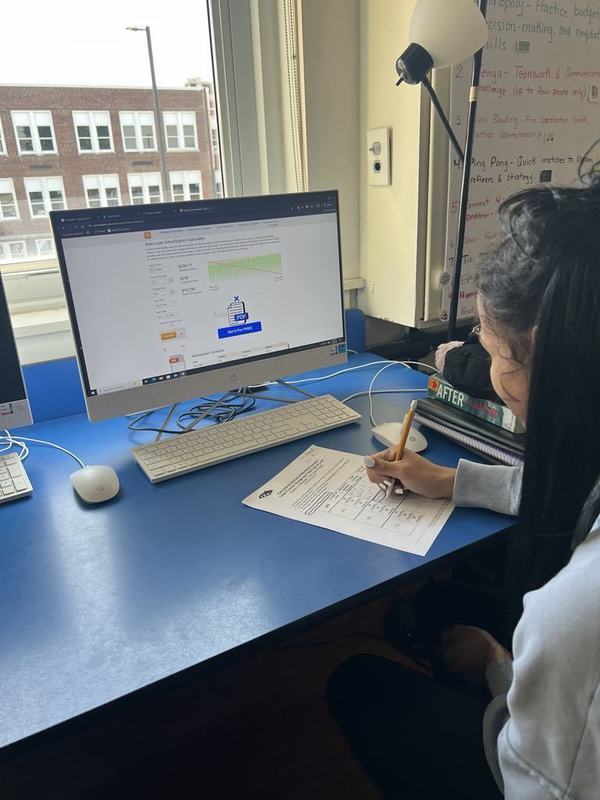

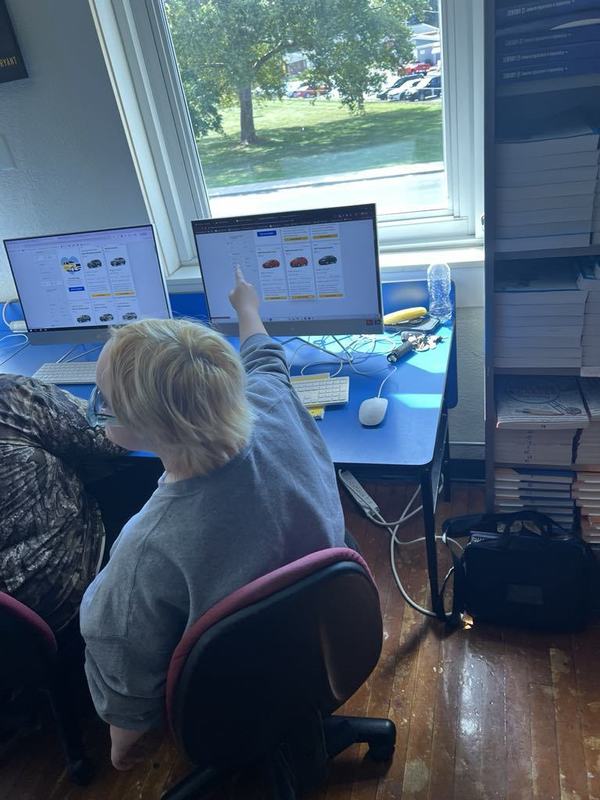

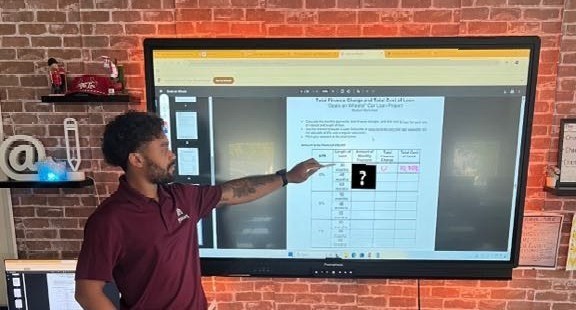

As part of the unit, students participated in an interactive car-buying simulation using the Kelley Blue Book Car Finder tool. They calculated monthly payments, compared loan term options, considered different down payment amounts, and used an amortization calculator to fully understand the long-term costs of car loans. Through these hands-on experiences, students gained practical knowledge about making informed financial decisions, managing credit responsibly, and avoiding common debt pitfalls.