This week, students in Mr. Griffin’s Personal Finance class participated in their highly anticipated semester financial simulation, an interactive learning experience designed to build real-world money management skills.

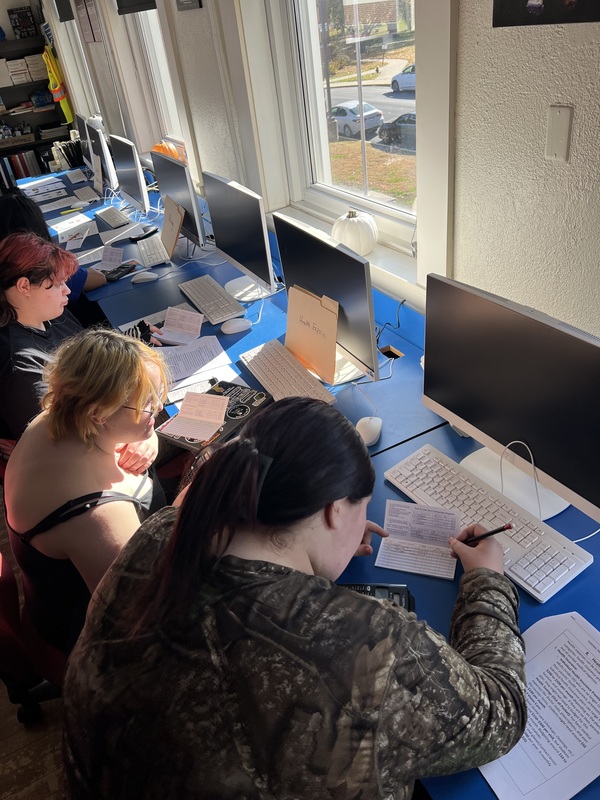

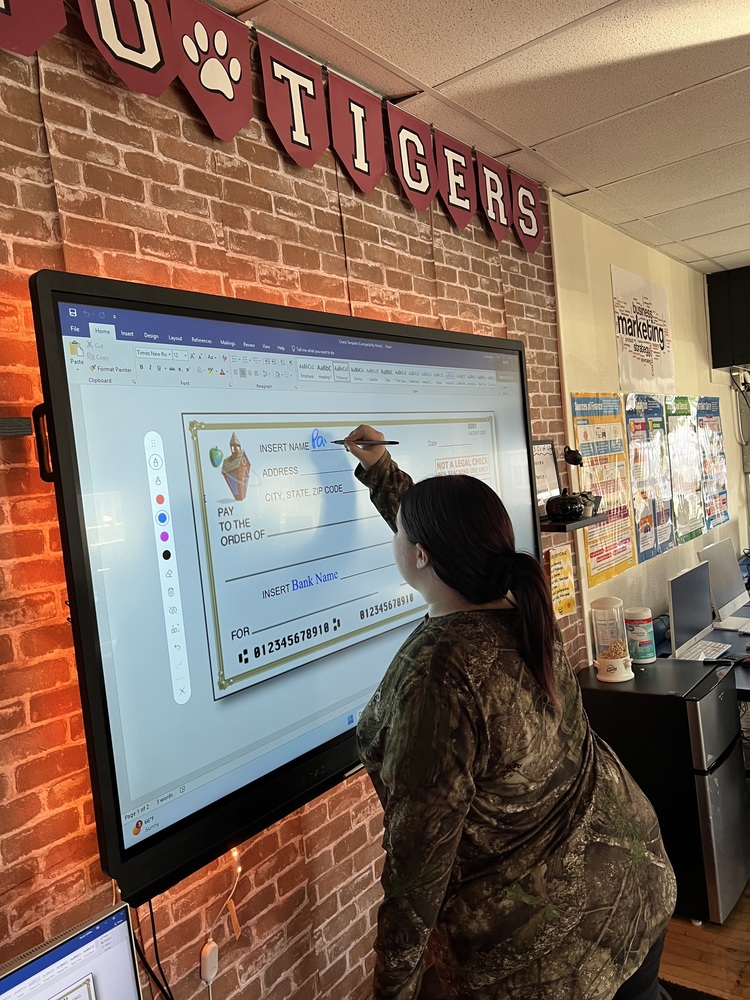

Throughout the simulation, students learned essential financial literacy concepts, including how to balance and reconcile bank statements using an account register. They practiced completing blank checks, identifying the parts of a check, and understanding how check-writing is still used in many financial situations today.

In addition, students explored the steps involved in opening checking and savings accounts, compared different types of banks, and learned when and why someone might need a money order. These lessons helped students better understand how financial institutions operate and how to choose services that fit their needs.

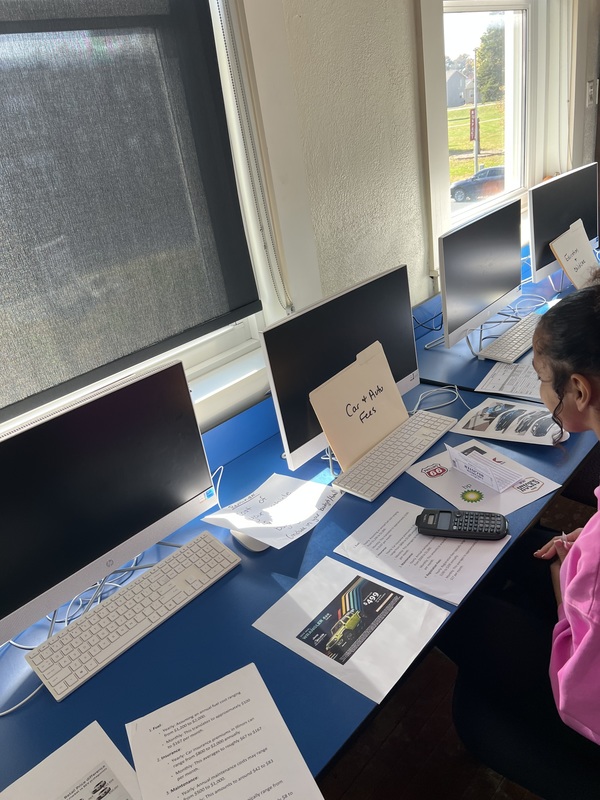

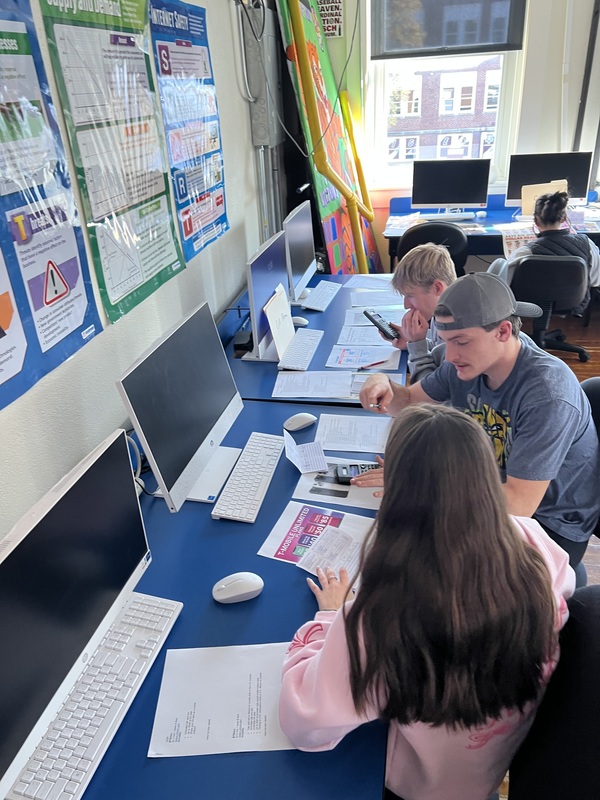

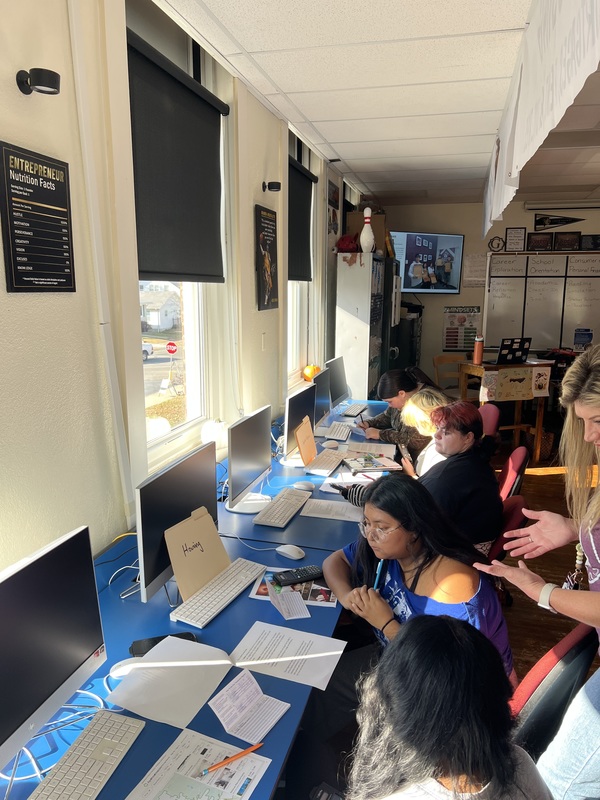

To put their skills into action, students rotated through station activities set up around the classroom. Each student used a checkbook register to record deposits, purchases, bills, and other transactions. Their financial decisions were based on a future career and projected salary, allowing them to see whether their lifestyle choices kept them financially stable—or sent them into debt.

The activity encouraged students to think critically about spending, saving, and responsible money management. Many were surprised to learn how quickly expenses add up and how important careful budgeting can be.

Mr. Griffin shared that the goal of the simulation is to prepare students for life beyond the classroom:

“Financial literacy is one of the most valuable skills our students can learn. This simulation allows them to experience real banking tasks in a safe, hands-on way. They walk away more confident and better prepared for their futures.”

Students left the experience with a stronger understanding of banking, budgeting, and financial responsibility—skills they will carry well into adulthood.